When a new drug hits the market, most people assume it’s protected by a patent that lasts 20 years. But that’s only the beginning. In reality, many blockbuster drugs enjoy market exclusivity for over 15 years - sometimes even 20 - long after the original patent expires. This isn’t a loophole. It’s a deliberate, multi-layered system built into U.S. and European drug laws. And it’s why you’re still paying hundreds of dollars for a drug that could be a $10 generic.

What Exactly Is Market Exclusivity?

Market exclusivity isn’t a patent. It’s a regulatory shield. While patents stop others from making the exact same chemical, exclusivity prevents competitors from even getting approval to sell a generic version - even if they don’t copy the patent. Think of it like this: a patent protects the recipe. Exclusivity stops anyone from opening a competing kitchen, even if they use their own ingredients. This system was designed by Congress in 1984 with the Hatch-Waxman Act. The goal? Encourage innovation while still letting generics in eventually. The original idea was simple: give drugmakers around nine years of protection after FDA approval, plus up to five more years if they lost time waiting for approval. That’s 14 years total. But today? Most drugs stay monopoly-priced far longer.The Five Big Exclusivity Tools in the U.S.

The U.S. FDA offers five main ways to extend market protection beyond patents. Each has its own rules, and companies stack them like building blocks.- New Chemical Entity (NCE) Exclusivity - 5 years. This is the big one. If a drug contains a brand-new active ingredient, no generic can even submit an application for five years. The clock starts when the drug is approved, not when the patent is filed.

- Orphan Drug Exclusivity - 7 years. For drugs treating rare diseases (fewer than 200,000 Americans affected). Even if the drug isn’t patented, this guarantee blocks competition. Over 38% of new drug approvals in 2022 were orphan drugs.

- New Clinical Investigation Exclusivity - 3 years. For a new use of an existing drug. You can’t just say, “This works for a different disease.” The FDA now requires real proof of clinical benefit - not just a tweak in dosing.

- Pediatric Exclusivity - 6 months added. If a company completes studies on kids as requested by the FDA, they get an extra six months tacked onto any existing exclusivity. For a drug with 5 years of NCE protection, that becomes 5.5 years. It’s a small extension, but it’s worth billions.

- 180-Day Generic Exclusivity - Not for brand companies, but for the first generic to challenge a patent. This creates a weird incentive: the first generic gets a head start, but brand companies often delay their own patent filings to avoid triggering it.

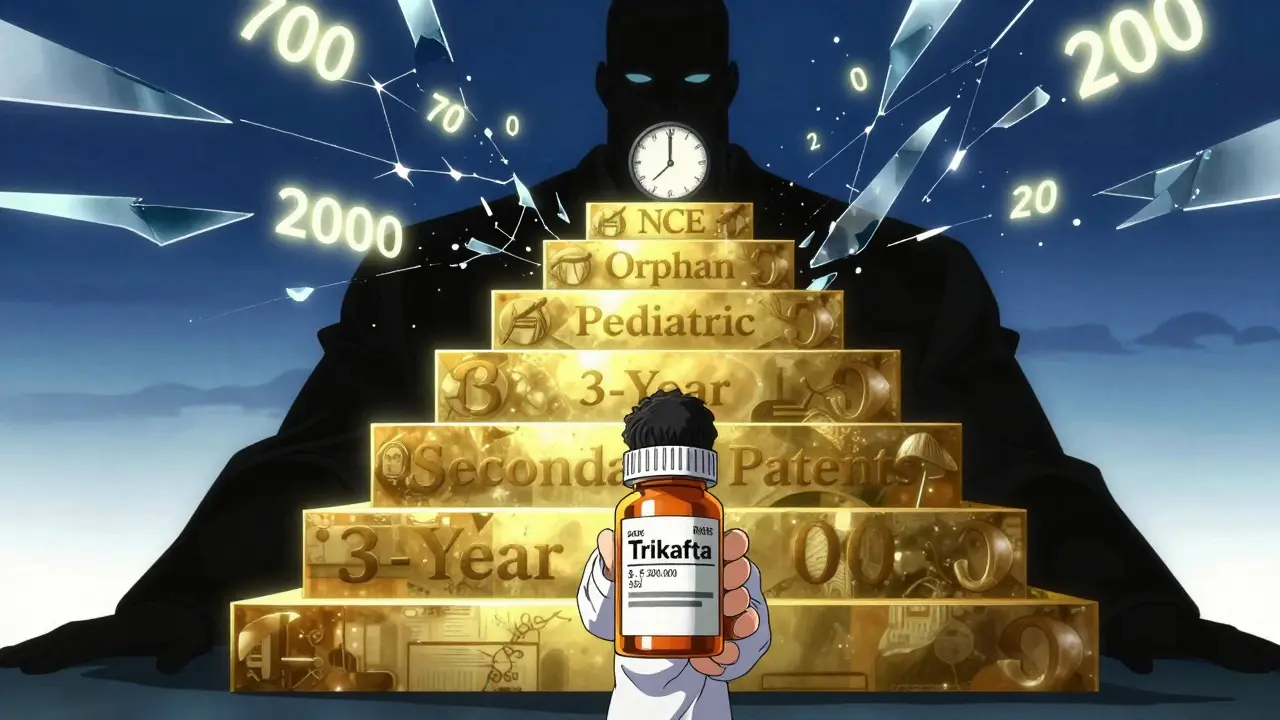

How Companies Stretch Exclusivity to 20+ Years

The real trick isn’t just using one tool. It’s stacking them. Take Vertex’s cystic fibrosis drug Trikafta. It had a core patent. Then it got NCE exclusivity. Then it got pediatric exclusivity. Then it got orphan drug status. Then it got 3-year exclusivity for a new dosing form. And that’s not counting the 48 secondary patents covering delivery devices, pill coatings, and combination therapies. The result? A 22-year monopoly on a drug that could’ve been generic in under a decade. This is called “evergreening.” And it’s not just happening on the edges. A Yale Law Review study found 91% of drugs that got patent extensions still had monopoly pricing well after those extensions expired - thanks to other exclusivities. Companies are also getting smarter about timing. Instead of filing patents right after discovery, some wait until after Phase II trials. That way, the 20-year patent clock doesn’t start ticking until the drug is almost ready to launch. Others delay filing until after they’ve secured exclusivity. The result? The patent expires just as the exclusivity ends - or even later.

How Europe Does It Differently

The EU doesn’t use the same system. Instead of patent term extensions, they issue Supplemental Protection Certificates (SPCs). These can extend protection up to 15 years beyond the original 20-year patent. They also offer 10 years of market exclusivity for orphan drugs - 12 if pediatric data is included. And unlike the U.S., they have a strict “data exclusivity” period: 8 years of protected data, 2 years of market exclusivity, and 1 extra year if pediatric studies are done. The EU is more rigid about what counts as innovation. They’ve started cracking down on “minor modifications.” In 2023, the European Commission proposed changes to stop companies from using SPCs just to extend protection for tiny changes - like switching from a tablet to a liquid. But here’s the catch: the EU doesn’t let you stack exclusivities the same way the U.S. does. You can’t add pediatric exclusivity on top of orphan exclusivity in the same way. That makes the U.S. system more powerful - and more abused.Why This Matters to You

It’s not just about big pharma profits. It’s about real people. The JAMA Health Forum found that just four drugs - bimatoprost, celecoxib, glatiramer, and imatinib - cost the U.S. healthcare system an extra $3.5 billion over two years because generics couldn’t enter the market. That’s billions that could’ve gone to insulin, asthma inhalers, or cancer drugs. For patients with rare diseases, orphan exclusivity is a lifeline. Without it, companies wouldn’t spend $1 billion developing a drug for 50,000 people. But for common conditions like high blood pressure or diabetes? The same tactics are used to delay generics for years. And it’s getting worse. Evaluate Pharma predicts that by 2028, the average drug will enjoy 16.3 years of market exclusivity - up from 12.7 in 2018. That’s nearly 10 years of monopoly pricing after the patent expires.

What’s Being Done About It?

Regulators are starting to push back. In 2023, the FDA tightened rules for 3-year exclusivity - now you need real clinical proof, not just a new pill shape. The FTC filed a brief arguing that “product hopping” - where companies slightly reformulate a drug right before generics launch - violates antitrust laws. But the system is still stacked. Companies spend millions on legal teams just to navigate exclusivity rules. A single blockbuster drug might have a team of 20 specialists managing patents, FDA filings, and pediatric study timelines. The cost of this game? Billions in profits - and billions more in patient costs.What’s Next?

The tension is clear: innovation needs incentive. But so does access. The current system was built for a different time - when drugs were simpler, patents were fewer, and generics were easier to approve. Today, the rules are being stretched thin. Some experts argue for capping total exclusivity at 12 years. Others want to limit orphan drug status to truly novel treatments. The EU is moving toward stricter innovation thresholds. The U.S. is still debating. For now, the system works - for the companies that know how to use it. For everyone else? The price tag keeps rising.Is market exclusivity the same as a patent?

No. A patent protects the chemical formula and stops others from copying it. Market exclusivity is a regulatory delay - the FDA won’t approve a generic, even if it’s legally different. You can have exclusivity without a patent, and vice versa.

Can a drug have both a patent and exclusivity?

Yes - and most do. In fact, the most profitable drugs often have both. The patent gives legal protection; the exclusivity gives regulatory protection. They work independently. A drug might have 20 years of patent life, plus 5 years of NCE exclusivity, plus 6 months of pediatric extension - meaning no generics for 25.5 years.

Why do generics take so long to come out?

Because even after a patent expires, exclusivity periods may still be active. For example, if a drug has 5 years of NCE exclusivity, no generic can even apply for approval until year five. Then, if it has pediatric exclusivity, generics still can’t launch until year 5.5. Plus, brand companies often file dozens of secondary patents to delay litigation.

Do orphan drug exclusivities really help rare diseases?

Yes - but only if used as intended. For conditions affecting fewer than 200,000 people, the 7-year exclusivity makes development financially viable. Over 1,000 orphan drugs have been approved since 2010. But some companies exploit this by labeling common drugs as “orphan” for minor subgroups - a practice regulators are now cracking down on.

What’s the longest market exclusivity ever granted?

There’s no official record, but drugs like tazarotene and certain cystic fibrosis therapies have been shown to maintain exclusivity for over 20 years through layered patents, orphan status, pediatric extensions, and reformulations. Some experts estimate the longest effective exclusivity in the U.S. exceeds 25 years.