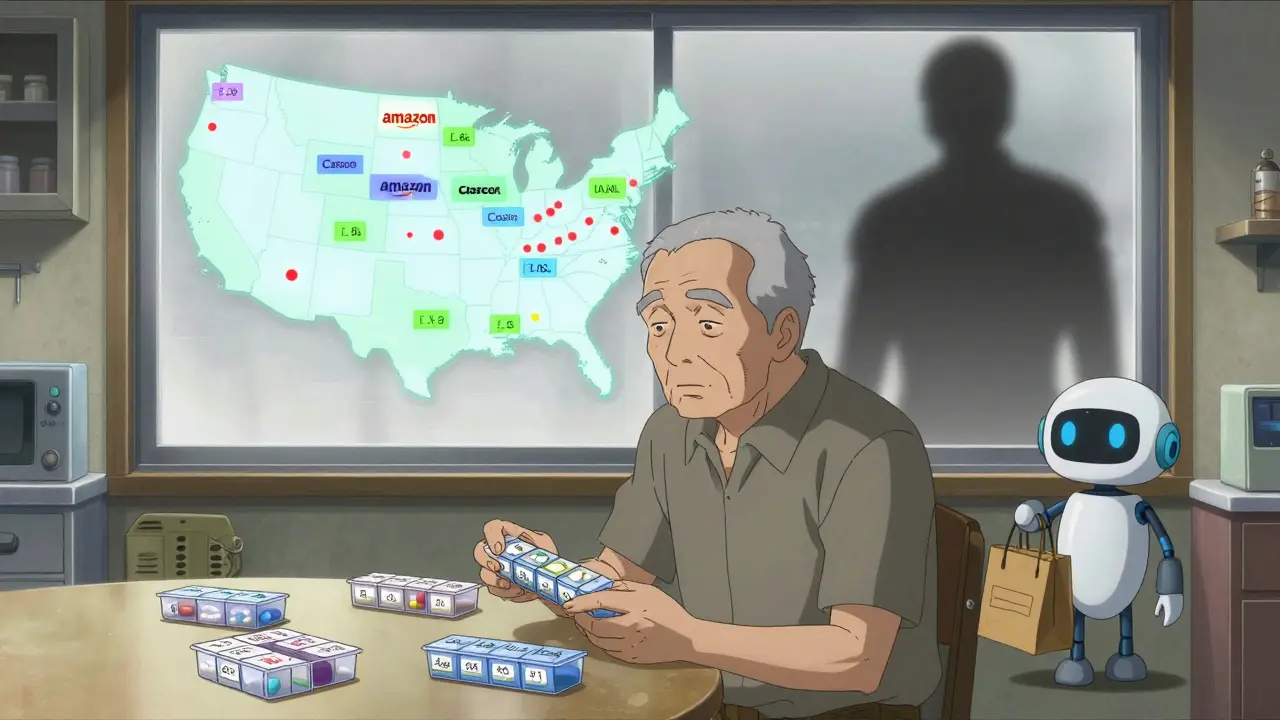

What if you could buy your generic prescriptions for less than the co-pay on your insurance? It sounds too good to be true-but it’s happening. Direct-to-consumer (DTC) pharmacies like Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, Costco, Walmart, and Health Warehouse are letting people pay cash for generic meds without using insurance. And for some drugs, the savings are massive. But here’s the catch: it doesn’t work the same way for everyone. If you’re on insurance, you might still pay less through your plan. If you’re uninsured, you could save hundreds. But only if you know where to look-and what to look for.

How DTC Pharmacies Work (And Why They’re Different)

Traditional pharmacies use pharmacy benefit managers (PBMs) to set prices. These middlemen negotiate rebates with drugmakers, but those savings rarely reach you. Instead, you get stuck with high co-pays, especially for expensive generics. DTC pharmacies cut out the middleman. They buy drugs directly from manufacturers and sell them at cost plus a small, fixed fee-usually around 15%. No rebates. No hidden markups. Just transparent pricing. For example, Mark Cuban Cost Plus Drug Company lists exactly how much they paid for each pill and adds their 15% fee. You see the real cost. No surprises. That’s why some people pay $3 for a 30-day supply of metformin when their insurance co-pay is $15.Where You Save the Most: Expensive Generics

Not all generics are created equal. The 50 most expensive ones-like those for high blood pressure, diabetes, or mental health-are where DTC pharmacies shine. According to a 2024 study in the Journal of General Internal Medicine, people saved a median of $231 per prescription on these drugs by buying cash pay instead of using insurance or retail pharmacy prices. Take gabapentin, used for nerve pain. On GoodRx, the cash price was $189. At Mark Cuban Cost Plus Drug Company, it was $27. At Amazon, $29. That’s more than 85% off. For a drug like allopurinol (for gout), savings hit $312. That’s not a typo. That’s real money for people paying out of pocket. Amazon Pharmacy came out on top for 47% of these expensive generics in the same study. Mark Cuban’s site was second at 26%. But here’s the problem: one in five of the most costly generics weren’t available at any DTC pharmacy. If you need one of those, you’re back to insurance-or paying full retail.Common Generics: Smaller Savings, Bigger Hassle

For everyday drugs like lisinopril, levothyroxine, or atorvastatin, the savings are real-but not as dramatic. The same study found median savings of just $19 per prescription. That’s still $228 a year if you refill monthly. But now you’re trading convenience for pennies. Costco leads here. For common generics, it had the lowest price 31% of the time. Amazon was second at 27%. Walmart came in third at 20%. Mark Cuban’s site? Only 10%. So if you’re buying common meds, Costco’s cash prices might be your best bet-even without a membership. Many locations let non-members buy prescriptions at their pharmacy counter. But here’s the trade-off: you have to check each site every time you refill. A drug that’s cheapest at Amazon one month might be cheapest at Health Warehouse the next. No single platform wins every time. And if you’re taking five or six meds? That’s five or six price checks every month.

Insurance Isn’t Always the Better Deal

You might assume insurance is safer. But that’s not always true. The USC Schaeffer Center found that in 2018, 90% of commonly prescribed generics in Medicare Part D cost less than $20 at Costco for a 30-day supply. That’s cheaper than most insurance co-pays. And then there’s the CVS Health study from 2023. It looked at 79 neurological generics-drugs for epilepsy, migraines, Parkinson’s. They found that Mark Cuban’s pharmacy carried only 33 of them. Of those, only two were cheaper than what insured patients paid out-of-pocket. That means for a lot of people on insurance, switching to DTC could actually cost more. Why? Because insurance plans often have negotiated rates that aren’t visible to you. Your $10 co-pay might be the result of your plan paying $30 behind the scenes. But if you pay cash at a DTC pharmacy, you’re paying the full retail price-unless that price is lower than your co-pay. And sometimes, it is.What You Can’t Get Through DTC Pharmacies

DTC pharmacies don’t carry everything. They focus on high-volume, high-savings generics. If you need a rare generic, a specialty drug, or a medication with a complex dosing schedule, you’re out of luck. The 2024 study showed that 20% of the most expensive generics weren’t available anywhere online. That includes some antipsychotics, cancer support meds, and rare hormone treatments. Also, DTC pharmacies don’t handle refills automatically. No automatic delivery. No reminders. No integration with your doctor’s e-prescription system. You have to order manually, track shipments, and manage your own supply. That’s fine if you’re tech-savvy and organized. Not so great if you’re elderly, have memory issues, or juggle multiple conditions.

Who Benefits the Most?

You’re most likely to save with a DTC pharmacy if:- You’re uninsured or underinsured

- You take expensive generics (like those for diabetes, heart disease, or mental health)

- You’re willing to spend 10-15 minutes comparing prices each month

- You don’t need rare or specialty drugs

How to Find the Best Price (Step by Step)

You don’t need a tool. You need a routine. Here’s how to do it:- Find your drug’s name and strength (e.g., “metformin 500mg”)

- Go to GoodRx.com and note the cash price

- Check Amazon Pharmacy, Mark Cuban Cost Plus Drug Company, Costco, Walmart, and Health Warehouse

- Compare all five prices

- Also check your insurance’s preferred pharmacy-sometimes the co-pay is lower than cash

- Order from the lowest price

Neil Thorogood

January 25, 2026 at 13:45So basically, if you’re not rich, you’re being robbed by PBMs and your ‘insurance’ is just a fancy middleman that takes 80% of the savings and calls it a ‘co-pay’? 🤡💸 I paid $2.50 for metformin at Cost Plus. My insurance wanted $18. That’s not a deal. That’s a heist. 🚨

Jessica Knuteson

January 26, 2026 at 14:24The system is designed to extract value not to deliver care. The illusion of choice is the most effective form of control. You think you’re saving money but you’re just participating in a different kind of market logic. Efficiency is not equity. And equity is not a feature of capitalism. Just data points in a spreadsheet.

Robin Van Emous

January 27, 2026 at 07:51I just want to say thank you for breaking this down so clearly. 🙏 I’m 68 and on a fixed income, and I had no idea I could be paying $27 instead of $40 for gabapentin. I checked three sites today and saved $112 on my monthly meds. I’m not tech-savvy, but I printed out the prices and took them to the pharmacy. It worked. Small wins matter.

Angie Thompson

January 29, 2026 at 07:04OMG I JUST SAVED $300 ON MY ANTIDEPRESSANT!! 🎉💖 I was crying in the pharmacy last month because I had to choose between rent and my meds. Now I use GoodRx + Cost Plus + Walmart like a game. It’s not perfect but it’s the first time I feel like I have power. You’re not broken - the system is. And we’re hacking it. 💪🔥

Geoff Miskinis

January 30, 2026 at 18:21Ah yes, the classic American solution: individualized price arbitrage as a substitute for systemic reform. How quaint. In a civilized society, pharmaceutical pricing would be regulated, not turned into a competitive scavenger hunt for the financially desperate. Your ‘empowerment’ is merely the sound of a broken system gasping for air.

Betty Bomber

January 31, 2026 at 19:13I’ve been doing this for two years. It’s a pain in the ass but worth it. I keep a spreadsheet. I check prices every two weeks. I’ve learned which sites update on Tuesdays. I don’t care if it’s ‘too much work’ - my blood pressure meds cost less than my coffee. And I drink a lot of coffee.

Mohammed Rizvi

February 1, 2026 at 00:54In India we just buy generics from local chemists for pennies. No apps. No websites. No drama. Just walk in, say the name, pay cash, leave. The system here is so messed up you need a PhD just to buy aspirin. I feel bad for you guys. But hey, at least you have GoodRx.

eric fert

February 2, 2026 at 06:20Let’s be real - this whole ‘cash vs insurance’ thing is a trap. You think you’re saving money? What about the hidden costs? The time? The stress? The fact that you’re now responsible for every refill, every shipping delay, every lost prescription? And what happens when you get sick and can’t log in? Who’s gonna help you then? The algorithm? The 24/7 chatbot? No. You’re on your own. And that’s not freedom - that’s abandonment dressed up as empowerment. And don’t even get me started on the fact that DTC pharmacies don’t carry half the drugs you need. You think you’re winning? You’re just being sold a lie.

Allie Lehto

February 2, 2026 at 19:30I think this is so important but also so sad. We’re adults who have to become price detectives just to survive. And the people who need this the most - the elderly, the disabled, the mentally ill - they’re the ones least able to do it. And then we act like it’s their fault for not ‘being proactive.’ It’s not a personal failure. It’s a societal collapse. And I’m tired. 😔

Napoleon Huere

February 4, 2026 at 03:45There’s a deeper truth here. The fact that we can buy metformin for $3 is proof that the cost of production is absurdly low. The real drug isn’t expensive - the system is. The patents expired. The chemistry is simple. The manufacturing is global. But the profit motive has been allowed to become a religion. We’re not fighting for lower prices. We’re fighting for the moral right to health. And until we name it that - until we stop calling it a ‘hack’ and start calling it a human right - we’ll keep playing this game. And someone will always win. And someone will always pay.